13th Month Pay Philippines Taxable

December - P 1000000. October - P 1000000.

Understanding The 13th Month Pay And Christmas Bonuses In The Philippines

The 13thmonth pay is exempt from tax up to a limit of PHP.

13th month pay philippines taxable. It is the current exemption cap after it was raised from Php 8200000. July - on maternity leave. Could the employer withhold the 13th month pay.

August - P 1000000. In countries like Austria the 13th and 14th month pay is taxed but at a significantly lower rate. Hindi ka makakalusot diyan.

June - on maternity leave. In the Philippines any payments over P90000 will be subject to taxes. With regards to the specific tax per amount to be implemented on the year-end pay-out that goes higher than Php 9000000 it was not specified in the primer.

Courtesy of the TRAIN Law this amount is relatively higher as compared to last years tax exclusion rate which is PHP. Hence if you receive a 13th-month pay amounting to more than Php 90000 the excess of said amount is included in your gross income and shall be taxable. Argentinas formula adjusts the 13th month pay to the number of months an employee actually worked.

If the excess benefits bonuses and the 13th month pay exceeds P82000 limit thats the time it is taxable as stated above. In case of non-payment of 13th month pay covered employees could complain at the Department of Labor and Employment DOLE or the National Labor Relations Commission NLRC. How this is done varies country to country.

Unless may tax shelter scheme kayo. MANILA Philippines The amount of tax-free 13th month pay has been raised to P90000 while the excise tax tiers on sugar-sweetened beverages have been. No the payment of 13th month pay is mandatory specifically provided under Presidential Decree PD No.

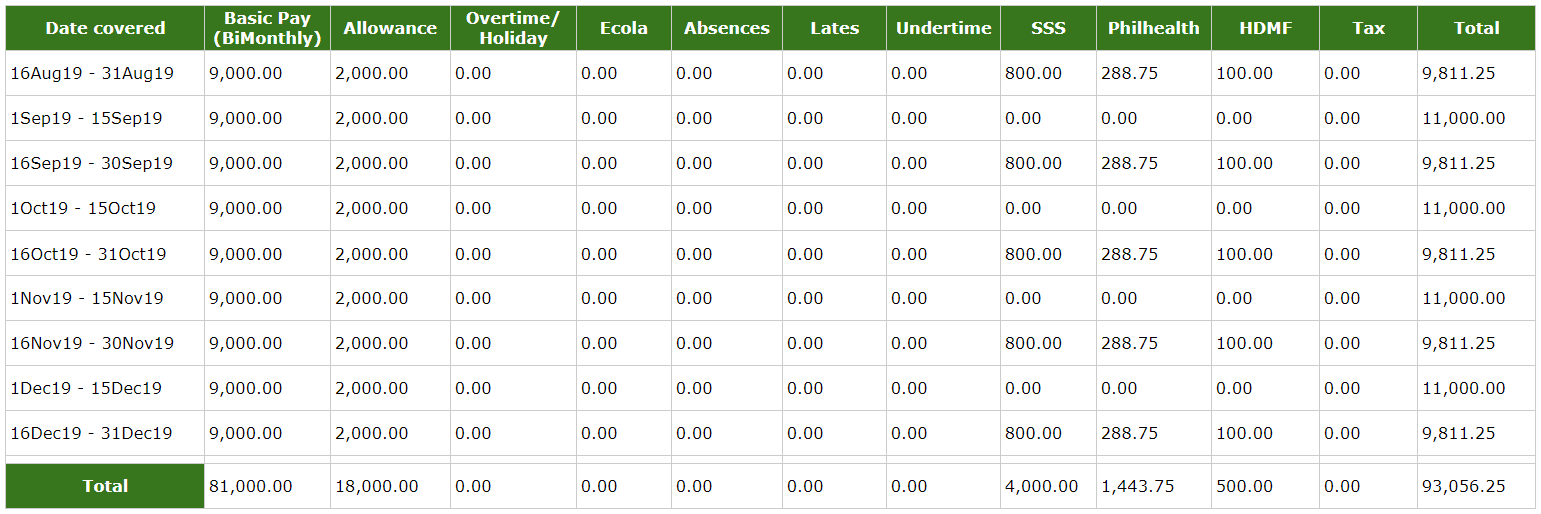

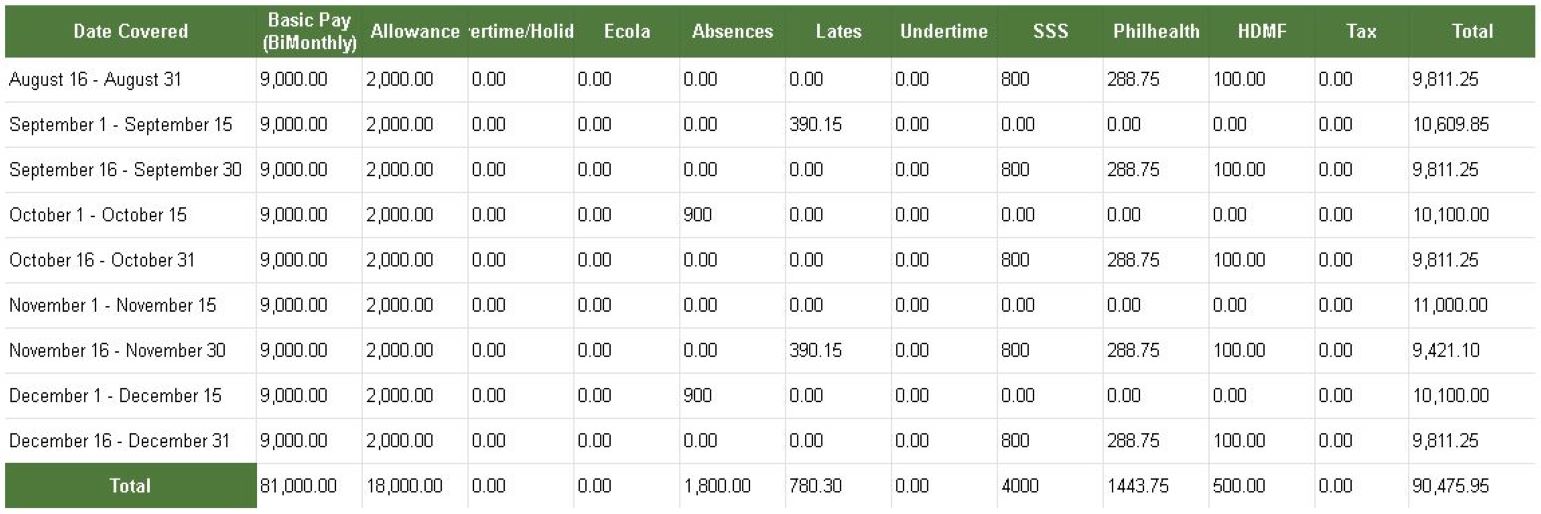

Is 13th month pay taxed. Employers can pay the 13th Month Pay benefit in installments but remember the full amount must be paid no later than 24 December. The 13th month pay is equivalent to one twelfth 112 of an employees basic annual salary.

However any payments over the one-twelfth denomination of the employees basic salary are taxable. This is also the case in the Philippines. 13th-month pay is usually exempt from any taxes.

November - P 1000000. To illustrate the following tax rules. The 13th month pay tends to be taxed.

13th month pay is taxable if it exceeds PHP 90000. Is 13th month pay obligatory. Based on the primer if your 13th month pay is Php 9000000 and below it is not subject for tax deduction.

The Christmas bonus is not a demandable and enforceable obligation and can only be released upon an employers voluntary. Understanding the 13th Month Pay and Christmas Bonuses in the Philippines Employers in the Philippines should understand the obligations around the 13th month pay and Christmas bonuses. We let them know that the 13th month pay is tax-free up to PHP 90000 and any amounts above that are taxable and the tax would be deducted from the final payment.

How to Compute 13th-Month Pay. Is 13th month pay taxable. Unless may tax shelter scheme kayo.

September - P 1000000. More updates may be posted soon. The DOF is seeking the repeal of provisions of the Tax Code that exempt from income tax the 13th-month pay Christmas bonus productivity incentives and other benefits up.

This is however subject to the rule on the P90000 amount for 13th month pay and other benefits where excess de minimis benefits may not be taxable if the total of such excess plus the 13th month pay and other benefits is within the P90000 limitation. Only the portion if any above the said amount is subject to regular income tax. There are two key aspects here for non-Filipinos hiring remote to remember.

Employers in the Philippines are required to pay the 13th Month Pay to all relevant employees on or before 24 December each year. And yes 13th 14th and 15th month pays are taxable. Hindi ka makakalusot diyan.

For example the exclusion rate in the Philippines is P90000the maximum amount allowed without taxation. The tax-free amount of PHP 90000 also includes other equivalent benefits like commissions and bonuses that have to factor into the calculation. P 833333 is the proportionate 13th month pay of a female employee who was on maternity leave from June 1.

Under the TRAIN Law 1 the 13th-month pay and other benefits received by an employee not exceeding Php 90000 are excluded from the computation of gross income and thus exempt from taxation. It is prescribed by Philippine labor laws as a mandatory benefit and should not be confused with the Christmas bonus commonly practiced in the local business setting. Under Philippine law 13 th month pay below the PHP30000 threshold is tax-exempt.

How To Compute For 13th Month Pay In The Philippines Coins Ph

Dole Guidelines For 13th Month Pay In Private Sectors

13th Month Pay 2020 Dole Labor Advisory 28 Train Law Compute Thirteenth Covid19 Pandemic Kasambahay Youtube

Everything You Need To Know About 13th Month Pay Sunstar

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

13th Month Pay Basics In 2019 Sprout

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

How To Compute Your 13th Month Pay 2020 Jobs360

Facts About The 13th Month Pay

13th Month Pay In The Philippines Computation And Guide

13th Month Pay An Employer S Guide To Monetary Benefits

Dole Guidelines For 13th Month Pay In Private Sectors

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

How To Compute 13th Month Pay 13th Month Pay Months Computer

13th Month Pay An Employer S Guide To Monetary Benefits

13th Month Pay Mandatory Benefit In The Philippines

How To Compute Your 13th Month Pay 2020 Jobs360

A Quick Guide To 13th Month Pay 13th Month Pay Months Payroll Software

Post a Comment for "13th Month Pay Philippines Taxable"