13th Month Pay Explanation

Thirteenth-month pay is a form of monetary benefit given to every rank-and-file employee. Its not a bonus because the 13th month pay is a benefit that.

How To Compute Your 13th Month Pay 2020 Jobs360

The formula is total basic salary minus total of salary deductions including absences lates.

13th month pay explanation. If the 13th month pay is set by statute rather than internal company policy then every employee is entitled to receive it. The Department of Labor and Employment Dole said that every rank-and-file employee in the private sector has the right to receive 13th-month pay provided they worked for at least one month in a year. In short 13th and 14th-month pay is the payment of an additional months salary during the financial year.

What is the 13th Month Pay. A 13-month salary refers to a payment made to employees above their normal salary usually equivalent to a months salary. 851 which requires employers to grant 13 th month pay to all its rank and file employees.

It is also known as 13th month salary or 13th salary and in some countries a 14th month salary is also common. 13th month pay is an additional amount of compensation usually calculated from a single months salary. The thirteenth month in most organizations is paid to employees who have successfully completed their probation and whose employment falls within the cut-off date for payment.

Thirteenth month pay is a form of compensation in addition to an employees annual 12 month salary. 13th-month payalso sometimes referred to as the 13th-month bonus 13th-month salary or thirteenth salaryis a monetary benefit that is either mandatory by law or customary for the countries that participate. What is 13th month pay.

It is a mandatory benefit provided to employees pursuant to Presidential Decree No. It is a mandatory benefit provided to. Any company that hires employees internationally is required to comply with the host countrys employment and compensation laws and labor rights.

A thirteenth salary or end-of-year bonus is an extra payment given to employees at the end of December. 13th month pay is an additional compensation given to employees in the Philippines typically at the end of a year. 612 buwan x P2400000 P12000.

The 13th month pay is not part of the regular wage of employees for purposes of determining overtime and premium payments fringe benefits contributions to the State Insurance. Note that 13th-month pay is computed as the number of months rendered by the employee which means additional holiday pays and premiums will not be included in the computation. The thirteenth-month pay is a monetary benefit paid to an employee at a specific period s of the year.

As of 2014 Italy Mexico Nicaragua Chile Columbia Argentina the Philippines and Brazil are countries that require employers to. It was legally introduced in the Philippines in 1975 where it is still enshrined in employment law. 13th month pay kung nakaisang buong taon.

The 13th month pay is defined as a monetary benefit based of an employees. Who are entitled to. WHAT IS 13TH MONTH PAY.

Although the amount of the payment depends on a number of factors it usually matches an employees monthly salary and can be paid in one or more installments depending on country. 13th month pay kung nakaanim na buwan. This type of payment is made as mandated by local law or as part of an employment contract.

It may be computed pro-rata according to the number of months within a year that the employee has rendered service to the employer. 13th month pay kung nakatatlong buwan. What is the 13th month pay.

10 things you should know about 13th month 1. What is 13 th month pay. According to the labor code The 13th Month pay means one twelfth 112 of the basic salary of an employee within a calendar year.

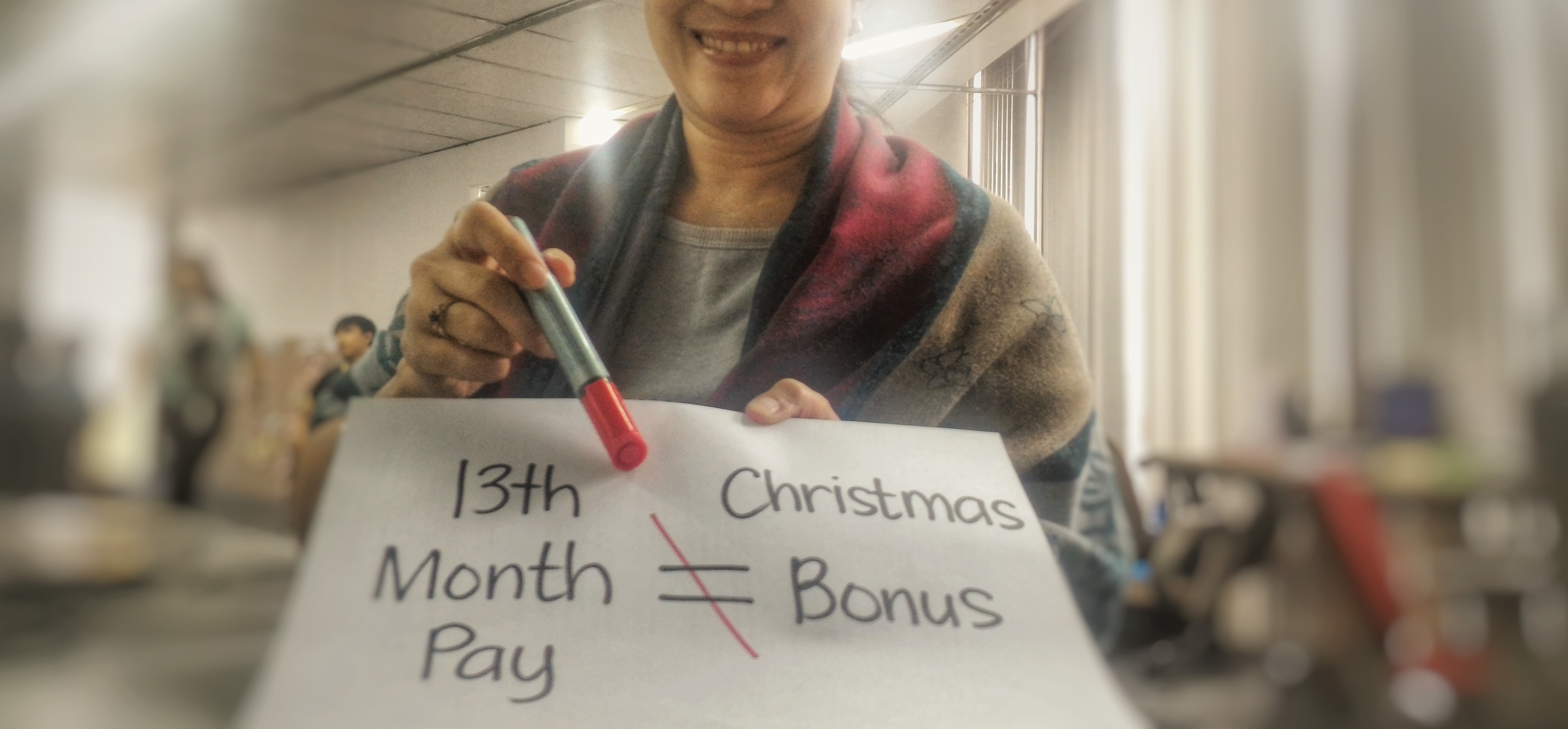

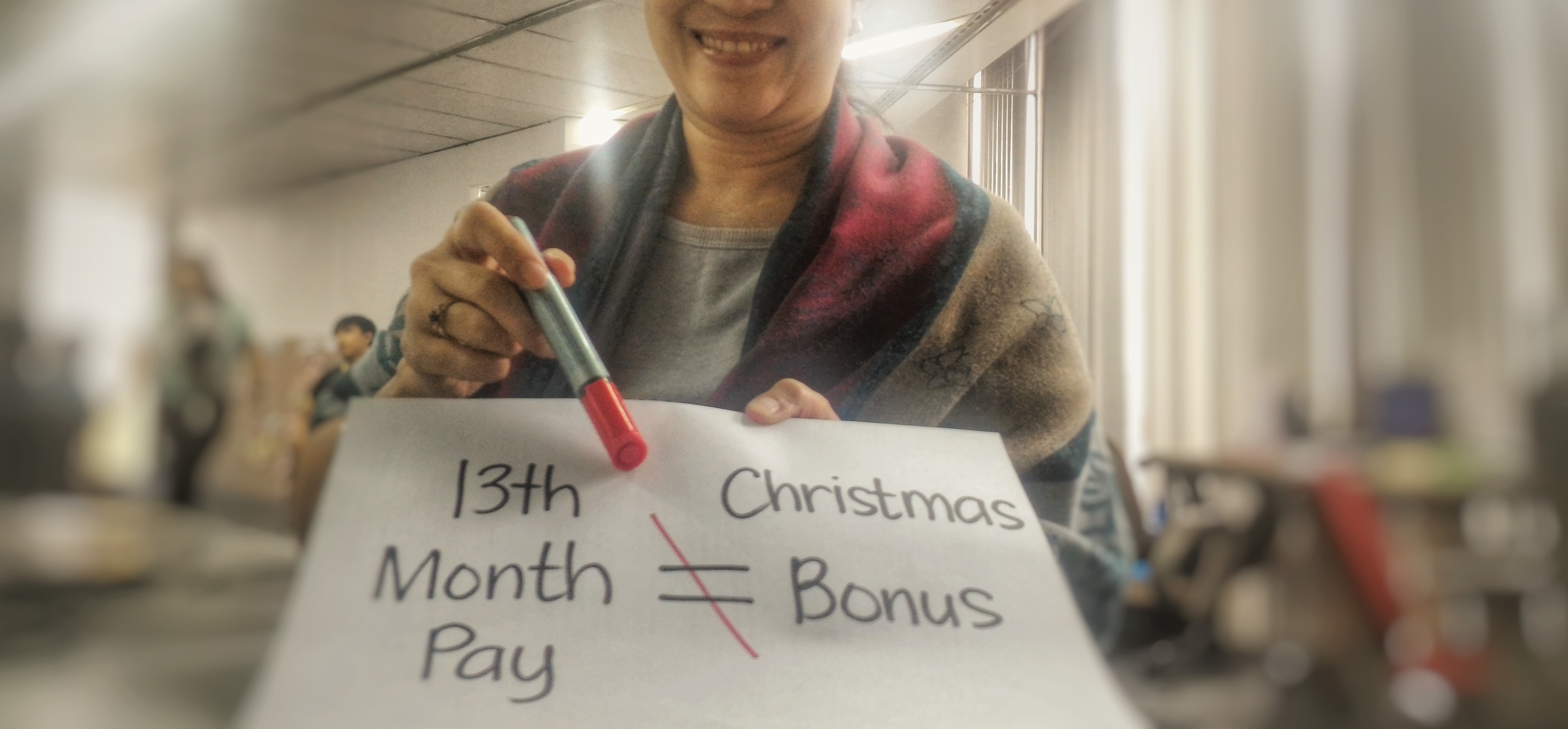

It is a monetary benefit mandated by law. The 13th month pay is not actually a bonus because a bonus is an incentive or a reward given to employees in excess of a business or an establishment success. The 13th month pay is considered a.

1212 buwan x P24000 P24000. Its a common practice around the world but there are some variations that rest on the specific employment laws of a particular country or legal jurisdiction. 312 buwan x P2400000 P6000.

To end the inquiries and confusion the 13th month pay is a mandatory benefit given to employees as part of the Presidential Decree No. For instance in Italy the 13th Month. Your 13th month pay is different from your Christmas bonus.

13th Month Pay In The Philippines Computation And Guide

New Dole Advisory On 13th Month Pay Requirements For Employers In The Philippines In 2020 Cloudcfo

How To Compute Your 13th Month Pay 2020 Jobs360

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

How To Compute 13th Month Pay 13th Month Pay Months Computer

13th Month Pay An Employer S Guide To Monetary Benefits

10 Things You Should Know About 13th Month

13th Month Pay An Employer S Guide To Monetary Benefits

Dole Guidelines For 13th Month Pay In Private Sectors

10 Things You Should Know About 13th Month

What Is 13th Or 14th Month Pay And How Do I Calculate It

Dole Guidelines For 13th Month Pay In Private Sectors

13th Month Pay An Employer S Guide To Monetary Benefits

Here S What You Need To Know About 13th Month Pay In The Philippines Jobstreet Philippines

13th Month Pay An Employer S Guide To Monetary Benefits

A Quick Guide To 13th Month Pay 13th Month Pay Months Payroll Software

Why The 13th Month Pay Is Not The Same As The Christmas Bonus Justpayroll

13th Month Pay An Employer S Guide To Monetary Benefits

Post a Comment for "13th Month Pay Explanation"