What Does Gross Pay Mean On W2

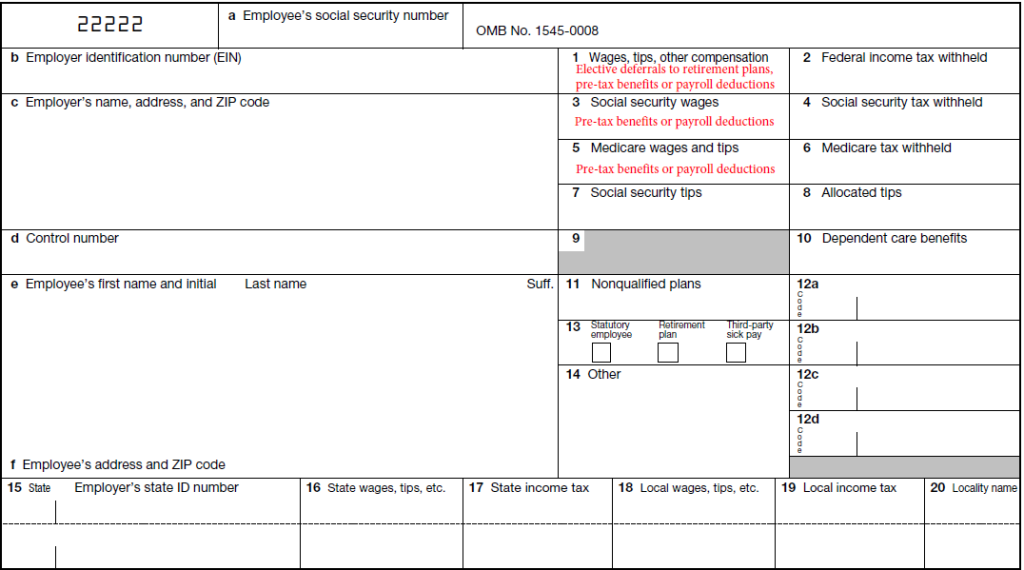

Boxes 1 3 5 16 and 18 are all wages boxes on the W-2 form. Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes and related deductions are taken out of it.

Gross wages are the amount a company pays an employee before any deductions are withheld.

What does gross pay mean on w2. A contractor is not an employee of the company and as such does not receive a W-2 form. You must use gross wages to calculate your employees net wages. How to Calculate Gross Income.

Gross pay is the amount you owe employees before withholding taxes and other deductions. Gross pay on a pay stub is the total wages an employee usually earns before payroll taxes and other deductions are taken out. What Does Gross Pay Mean.

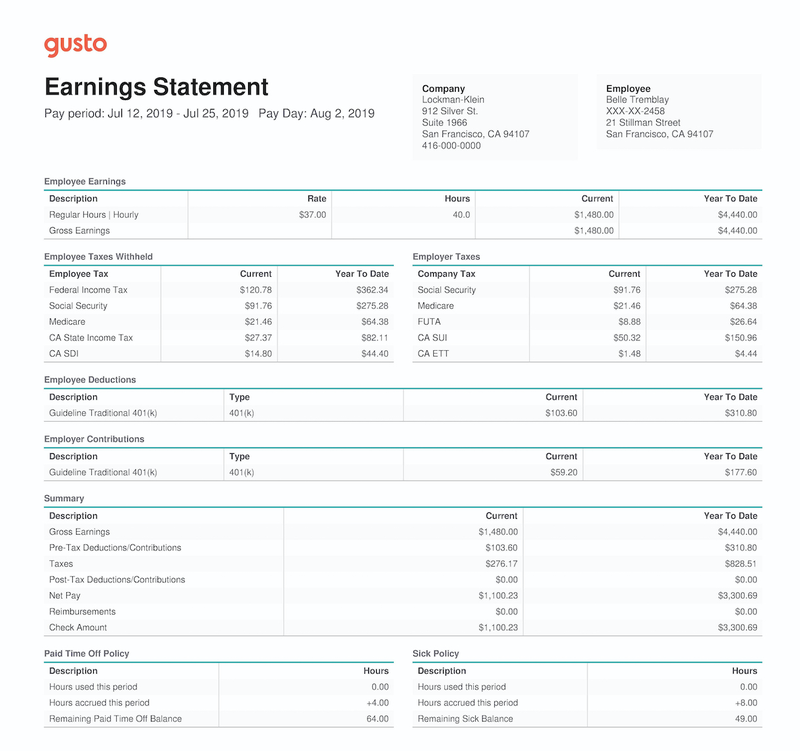

Net pay Your gross pay will often appear as the highest number you see on your pay statement. Social Security and Medicare taxable wages. As a W-2 contract it means youre an employee and the employer will pay your employment taxes and such but you will have taxes deducted toward a number of different things.

W1 reporting and Salary Sacrifice. Use your last pay stub for the year to calculate the taxable wages in boxes 1 and 16 in your W-2. What does gross and net pay mean.

Gross pay often called gross wages is the total compensation earned by each employee. On a W-2 tax statement an employees federal taxable gross wages appear in Box 1 which is located near the top-center of the form. Under the pay category settings ensure the Exclude from W1 in journals option is ticked.

Net pay is what an employee takes home after deductions. A W-2 is a year end form issued to employees which has a summary of their annual gross earnings and income tax withholdings. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out.

First start with your gross income. Gross pay is not the amount you pay your employee. For Social Security and Medicare deferred income 401k 403b Simple IRAs etc is considered taxable and not subtracted from gross pay.

However these wages dont always correspond to an employees gross wages from their final paycheck. If you are being paid as a contractor the gross amount you earned is what will wind up in your pocket throughout the year. Gross pay does not take into account any pretax deductions or other exemptions from income.

Adjusted Gross Income on W2. Gross Pay Including tips and taxable fringe benefits Subtract. Go to payroll settings pay categories and click on the pay category you dont want reported at W1 on your BAS.

In one to two sentences list some deductions you may see on your paycheck. Does a paycheck stub documents just your gross pay. W-2 Box 1 Wages vs.

Deductions help the world go round or at least help take the sting out of tax season. You receive an hourly rate for your work you will often have the opportunity to opt into partial benefits you will fill out. So with 52 weeks in a year and without factoring in any overtime pay or time off without pay then you would be looking at about 104000 per year gross salary.

Begin with the Gross Pay YTD year-to-date and make the following adjustments if applicable. The term gross income for tax purposes refers to how much you make. Wait for your W2 because you may have pre-tax deductions such as 401K contributions that will reduce your gross earnings that may not be reflected or accurately reflected on your last pay.

In laymans terms W2 hourly is like short term employment. Gross pay is the total amount of pay received before any deductions. Section 125 deductions medical dental vision dependent care pre-tax commuter benefits etc Equals.

Net pay is the amount of pay after deductions for tax and pensions. Now when you pay an employee under these earnings they wont be reported as W1 on the journal. For example if the employees gross pay is 50000 for a year with a monthly pay schedule then 5000012 is the gross wage for every pay period.

How many children you. Net pay is the amount you give to your employee. Means all amounts received for services actually rendered in the course of employment with the Company to the extent that such amounts are includible in gross income as wages for federal income tax purposes plus all amounts that are contributed by the Company pursuant to a salary reduction agreement and which are not includible in the gross income of the Executive under.

This may confuse employees whose annual salaries and W-2 wage reporting dont match. For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay. The most common reason for this discrepancy is the impact of pretax deductions such as Section 125.

For example say that your salary is 62000 but you contribute 2000 to your 401 k plan pay 2500 in health insurance premiums and contribute 1000 to your FSA. A paycheck stub documents just your gross pay. Notice I didnt say it was the total amount paid to each employee.

Subtract YTD Before-Tax Deductions which include Medical Dental Vision. Gross pay represents the total amount paid by a company to its employees. Federal Taxable Wage Adjustments to Gross Pay YTD.

Gross Pay And Net Pay What S The Difference Paycheckcity

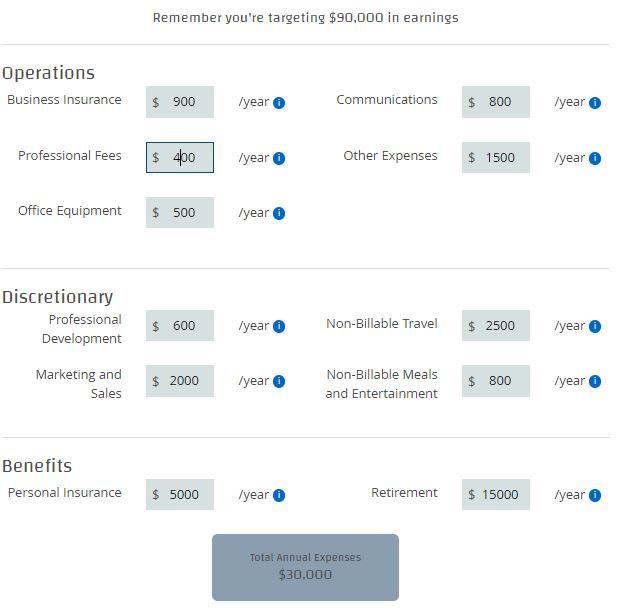

New Business Do These Three Things First Amy Northard Cpa The Accountant For Creatives Small Business Tax Small Business Tips Small Business Finance

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Triggers Marshall Goldsmith Visual Synopsis By Dani Saveker Marshall Goldsmith Synopsis Book Summaries

Magdalena Schmitz Has Undergone Some Major Changes Chegg Com Homework Help Income Tax Return Change

Form 1040 U S Individual Tax Return In 2021 Irs Tax Forms Tax Forms Tax Return

Agi On Form 5 The Ultimate Revelation Of Agi On Form 5 Adjusted Gross Income Money Talks Tax Brackets

1099 Income Amazon Ebay And Google Give You A 1099 If You Earn Over 600 That Doesn T Mean You Don T Have To D Adsense Google Adsense Money Google Adsense

Understanding The Contents Of A French Pay Slip Fredpayroll

Irs Forms 1099 Are Coming The Most Important Tax Form Of All Irs Forms 1099 Tax Form Tax Forms

Difference Between Reported W2 Wage And Gross Pay

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

Gross Wages What Is It And How Do You Calculate It The Blueprint

How To Complete A Schedule C For Your Handmade Business Handmade Business Handmade Sellers Handmade

Pos408 User Error Exception Handling Week4 Solved Logicprohub Data Structures Software Development Solving

Understanding The Contents Of A French Pay Slip Fredpayroll

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Wage Calculation Defined Contribution Plan Auditor

Post a Comment for "What Does Gross Pay Mean On W2"